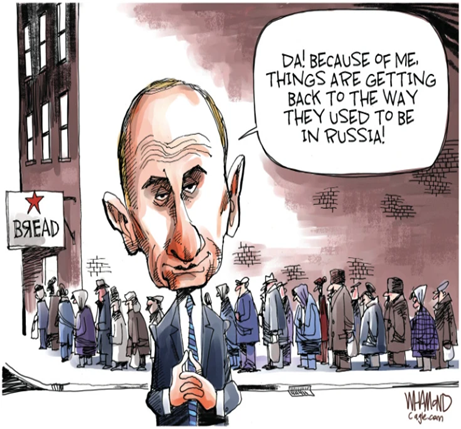

Looking back at our year-end commentary, we did not think that Vladimir Putin would send his troops across the Ukrainian border and wreak havoc on his neighbor. We were obviously wrong. Laying out our argument in rational terms (and this is probably where we got it wrong because we looked at the situation logically, not emotionally), we did not believe that President Putin would, through his provocation, want to: unite NATO and bring its troops closer to his borders, unite the European Union (the EU) to exact trade restrictions on Russia, unite the USA and the EU economically and militarily as they have not been since World War II, make Russia a diplomatic pariah throughout the world, put an almost immediate strain on Russia’s newly christened “special relationship” with China, irritate the U.S. enough to enact trade sanctions never imposed on another country, and anger the U.S. Congress so much that there is strong bi-partisan support to punish Russia both economically and militarily. The ruble has collapsed by some 40% – 50%. Inflation is “roaring” and interest rates have been hiked to 20% by the Russian Central Bank. The Russian stock market was shuttered for nearly a month, reopening just recently. The only action we did not foresee when we wrote at the end of 2021 was the wave of corporate abandonments (VISA, Coca Cola, Adidas, Samsung, JP Morgan, Nissan, Delta Airlines, etc.) from around the globe. These companies have stopped doing business in Russia in response to the Ukrainian invasion. Thus, the everyday conveniences of life to which Muscovites have become accustomed (like using their American Express card or going to McDonalds for lunch) are no longer. This effect is immediate, one not anticipated by us and will have a demonstrable effect on the Russian psyche. Imagine one’s economy being thrown back 40 years to the bread lines of the old Soviet Union just before it collapsed and from which Russia was born. Those were not happy days then and will not be happy days in the near future. Some economists think that the Russian economy could shrink by 9% – 14% in 2022. Mr. Putin could well pay a “steep price” exacted by the Russian people for his international imbroglio. But what will this geopolitical mess mean for American markets?

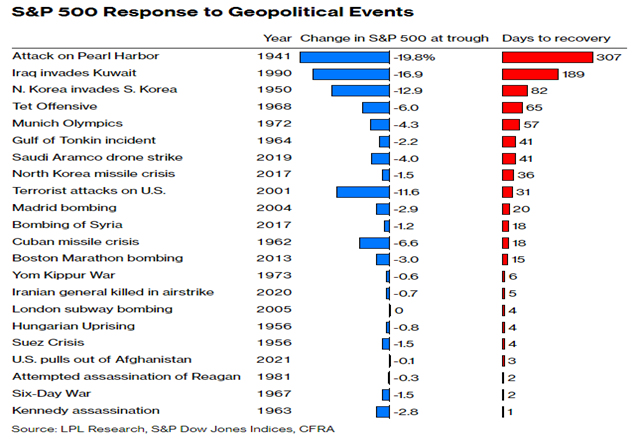

Chart 1

The above chart provides some help in answering this question. Looking at the reaction of the S&P 500 to a wide range of geopolitical events since the attack on Pearl Harbor, the reader will note that the worst “drawdown” was 19.8% and that was for Pearl Harbor. That decline also took the longest time to recoup – 307 days, i.e., not even a year. Recognizing quickly that the past is not always prologue, nevertheless the diversity of this geopolitical mess menu and the long period of time from which the samples were drawn should strengthen investor resolve that politics do not drive markets. Rather, as we have noted in past writings, company earnings drive markets. So how are we doing on that score?

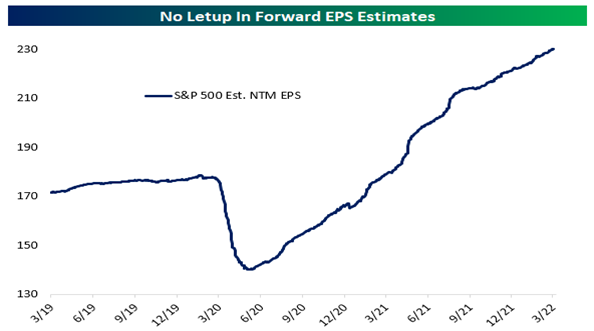

Year-end 2021 and fourth quarter corporate results season have just finished. Happily, company performance continued to be strong. Fourth quarter earnings were +26.9% and sales were +15.6%. For all of 2021, earnings were +49.2% and sales were +15.4% (source: I/B/E/S data by Refinitiv). The outlook for 2022, according to Wall Street analysts, has continued to climb.

Chart 2

Source: Bespoke

Markets do not like uncertainty. Certainly, the invasion of Ukraine introduces some “uncertainty” into any investor’s calculation of future market returns. However, we do not think that recent market setbacks are only due to Ukraine. We believe that most of the 2022 stock market malaise is due to multiple compression – i.e., investors are willing to pay less for any dollar of earnings than they were earlier. In short, the forward-looking price/earnings ratio (P/E) has gone down. In the face of a strong finish for 2021 company results and a positive outlook for 2022 corporate results, stock prices have declined. Good company news is ignored and bad news is punished severely. We believe the lower P/E ratio is due to higher interest rates and we noted in our year-end commentary that there would be these competing forces of strong earnings and higher interest rates pushing prices. This competition between earnings and interest rates will continue throughout 2022 and thus our outlook for stock prices in America, while positive, is more muted than in past years. Further, the war in Ukraine does not help, because it puts investors on edge.

Internationally, equity valuations are still cheap. With commodity prices rising strongly because of war drums beating, emerging markets, more exposed to commodity exports as a percent of national GDP than developed economies, should be beneficiaries of the current environment. This is true – but war anywhere dampens investor enthusiasm, with regard to markets perceived to be of higher risk. The developed markets, mostly in Europe, are deemed embroiled in the “Ukraine action” – so enthusiasm for them has been muffled. China is still dealing with outbreaks of COVID, its sick real estate industry and the central government’s crackdown on “Big Tech”. The country’s GDP growth will come in around 5% for 2022, which will be very slow for China as compared to its past growth rates. So, overseas stocks are inexpensive. Investors, however, need a catalyst to buy.

OIL AND INFLATION…

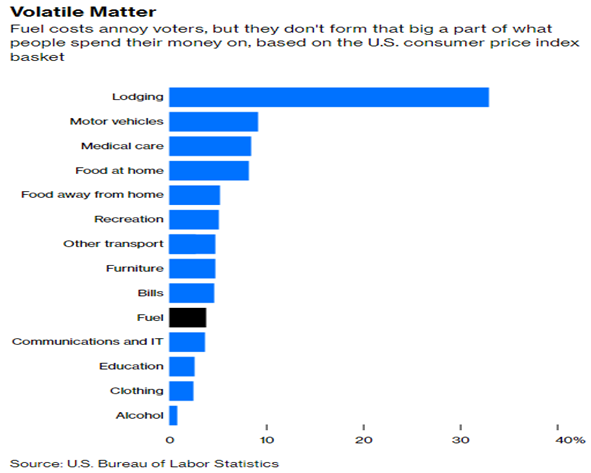

The headlines are big. Oil prices, at one time negative in 2020, are now over $100/bbl., an absolutely amazing turnabout and one that few expected. Supply discipline exercised by OPEC+ (note: Russia is a member) and financial discipline forced upon U.S. oil companies by shareholders over the last two years have righted the upended oil & gas markets. Also introduced into the “price mix” is the invasion of Ukraine by Russia and threats of cutting off energy supplies to the West by Russia as well as embargos of Russian oil and gas by the West. Fuel costs annoy people. It is an everyday cost that people deem necessary, like to get to work. It is also an expense people see every day as they travel about, advertised on most every street corner. So, a constant reminder is always “front of mind” and when prices go up for this necessity, it is annoying. But is it a big part of what people spend their money on? According to the U.S. consumer price index (CPI) basket, no.

Chart 3

As can be seen from the above, out of 14 categories of expense, fuel ranks number 10 out 14. No doubt, higher oil prices, which lead to annoyingly higher gasoline prices, will contribute to higher inflation. But fuel costs account for only about 4% of the U.S. CPI – less than what people spend on restaurant meals, furniture or recreation.

MECHANICS AND SIR JOHN…

Institutional investors (think pension plans and sovereign wealth funds) are about to shift about $230B from bonds to stocks, in order to rebalance portfolios after the decline in equity prices so far this year. This rebalancing will be done to maintain their portfolio discipline according to their investment strategy. This redeployment of capital is mechanical – but should lead to equity price support. Further, in the face of inflation, bonds are not a place that any investor wants to be. So, fear of inflation is also pushing people out of bonds and into stocks.

Sir John Templeton was from a small town in Tennessee who later became famous as an investor around the world, founding what became one of the world’s largest investment/mutual fund firms, Franklin Templeton Investments. He was knighted by Queen Elizabeth for his humanitarian efforts and finished his days living at Lyford Cay in the Bahamas. In 1939, just after Adolf Hitler invaded Poland and started World War II, Sir John, a 26-year-old man then, called his broker and instructed him to buy $100 worth of every stock trading on a major exchange for less than $1/share. In fact, Sir John borrowed $10,000 to help finance his investment. He invested in 138 companies. He held his investments through the fall of France, the attack on Pearl Harbor and the Nazis rolling into Russia. Reportedly throughout, he was scared because he was, as were so many, looking at the possible extinction of civilization as most people knew it. But he held on. In 1944 he sold his investments, quadrupling his money. Successful investing requires courage – not only to act as Sir John did as a young man in 1939, but also to resist doing the “easy thing”. It was hard to buy in 1939 as the world was “going up in flames” and hard to resist selling too soon as things in the world got even worse. It would have been “easy” to sell in 1940 or 1942 – but Sir John held and made a lot of money.

PREDICTIONS FOR 2022

- Interest rates to rise a bit in 2022. Yes – The Fed just announc4ed the first of several anticipated rate increases.

- The dollar will be firm. Yes – Due to interest rate increases & overseas troubles.

- Corporate earnings will be strong – but not grow as fast as in 2021. Yes – So far, so good.

- U.S. infrastructure spending will take off. Yes – Should start soon, courtesy of Washington.

- China will continue to threaten Taiwan, but not move on Taiwan. Yes – so far.

- Russia, after lots of “saber rattling”, will back away from Ukraine. No – This is the “headline” for 2022.

- Oil will stay well priced. Yes – Strong demand & the Ukrainian War have been supportive.

- Inflation will “simmer down” from closing 2021 levels. No – Inflation has been surprisingly strong.

- Investor “risk appetites” will stay strong. No – There is some nervousness because of Ukraine.

- U.S. stocks will continue to make progress – but more subdued than in 2021. No – We still believe, but not so far.

A FINAL THOUGHT

The opinions expressed in this Commentary are those of Baldwin Investment Management, LLC. These views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

The reported numbers enclosed are derived from sources believed to be reliable. However, we cannot guarantee their accuracy. Past performance does not guarantee future results.

We recommend that you compare our statement with the statement that you receive from your custodian.

A list of our Proxy voting procedures is available upon request. A current copy of our ADV Part II & Privacy Policy is available upon request or at

www.baldwinmanagement.com/disclosures.