Two fundamental forces move equity prices – earnings and interest rates. Of course, there can be other influences like politics, pandemics or wars at any particular moment in time which can briefly overwhelm earnings and interest rates in determining stock and bond prices. We saw that in 2020. But over the broad sweep of market history, the two fundamental forces have more often than not set price levels in the marketplaces.

In Chart 1 below, the reader will note the “boom” in anticipated earnings growth for corporate America as projected by Wall Street analysts. New records are expected and not just by a little – but by a lot.

CHART 1

Skeptics think the expectations are too high, except that companies have been exceeding Wall Street estimates for several years quite handily. So while stock prices may be high, there is fundamental company earnings support underpinning them.

The second pillar of support comes from extremely low interest rates and interest rate levels which, while expected to go up in the future, are not projected to rise too quickly or dramatically. As of this writing, the 10-year Treasury note yields about 1.26%.

CHART 2

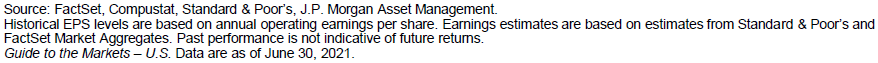

In Chart 2, the interrelationship between interest rates and equities is examined from 1965 until present day. From 1965 until January 2009, bonds did not offer competition to stocks until bond yields reached 4.5%. Until that 4.5% yield was achieved in the bond market, fixed income yields could go up and so could stock prices. After yields went through the 4.5% level, equity prices reversed as bonds started to offer an attractive risk adjusted return versus riskier stocks. From February 2009 through to today the hurdle rate for competition from bonds has gone down to 3.6%. This most probably is due to the low inflation (i.e., disinflationary) environment in which markets have been operating since the Great Recession of 2008 – 2009. So while the “bond yield hurdle rate” has dropped from 4.5% to 3.6%, the current 10-year Treasury note rate is just 1.26% – a long way from 3.6% – so again stock prices are fundamentally supported.

China has been in the news a lot lately and the news has not been good for Chinese companies. It is accepted widely that it is never a good idea to get “cross ways” with Beijing. The Communist Party (CCP) may be a bit slow to react to an infraction – but react it will and sometimes with considerable consequence. Recently regulators of “all colors and stripes” have been left to pillage corporate China. Large fines have been imposed on Alibaba, much anticipated and major initial public offerings (think ANT Financial) have been pulled, Didi’s company apps have been shut down by regulators and the for-profit education industry has essentially been dismantled. Certain stocks have been routed. Investors around the world are selling first and asking questions later. The Chinese stock markets have shuddered. While very painful and difficult to fathom, this has happened before in China. The Tiananmen Square crackdown of Chinese students and intellectuals was an historic event, far more brutal than today’s regulatory routs. Yet, it is another example of how the CCP periodically brings the Chinese people “to heel”. Freedoms are allowed, but only so much and never enough to threaten the Party. If the CCP feels that its supremacy in China is being tested by students or corporate “kingpins”, it will shut that threat down. But China has recovered in the past and we believe it will do so now. Those who commit infractions repent and everyone else forgets the incidents over time because China is too big an economic opportunity to ignore. Chinese order will be restored. The Chinese markets may not be an investor favorite for a while, however.