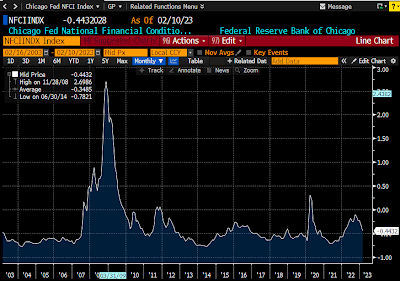

As we start 2023, let’s take a look at a chart put out by the Chicago Fed, the Financial Conditions Index, which measures the current economic conditions in the US using a matrix of economic statistics. Higher values reflect deteriorating conditions and lower values represent improving conditions. As the reader will note below, there is no sign of an impending recession.

CHART 1

Corporate credit spreads (i.e., the difference between junk yields and higher quality yields) are narrow also suggesting that there is no economic strain. Further, liquidity in banking circles and within the corporate world is ample – also strongly suggesting that there is no imminent risk of recession.

INDIA…..

One of our predictions for 2023, as outlined in our year end Commentary, is that international stocks would outperform US equities – continuing the outperformance started last year. India is becoming a manufacturing hub for many international companies looking to diversify their supply chain out of China. Apple has already set up shop and started to produce several of its products in the country, with more to come. India is a democracy with a huge population (recently estimated to exceed China’s population) which is young, quite digitally literate and which speaks English. The Indian economy is slated to be the fastest growing large economy (already #5) in 2023, projected to grow +6.6% as compared to the US at 0.5% and China at 4.3%. There is political will behind the development of the country. More than $24B of incentives will be provided to help over a dozen industries (think solar panels, mobile phones, semiconductors) compete against China. Last month, US Commerce Secretary Gina Raimondo told CNBC that the US is looking to collaborate with India on manufacturing jobs to boost competition with China. According to some investors, China is uninvestable today because of unpredictable politics. India is increasingly recognized as the next stop on the globalization supply chain, increasingly looked at as China was 40 years ago with a burgeoning middle class and a young workforce.

DON’T FORGET DIVIDENDS…..

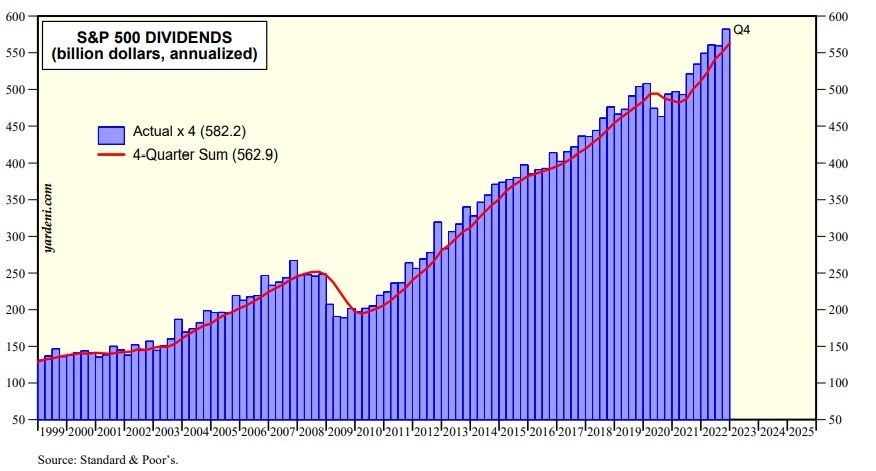

Historically, it has been the case that dividends provide a significant portion of an investor’s total return. In 2022, even while stock prices were declining, dividends were raised by corporate America to a record high of $562.9B as demonstrated in Chart 2 below.

CHART 2

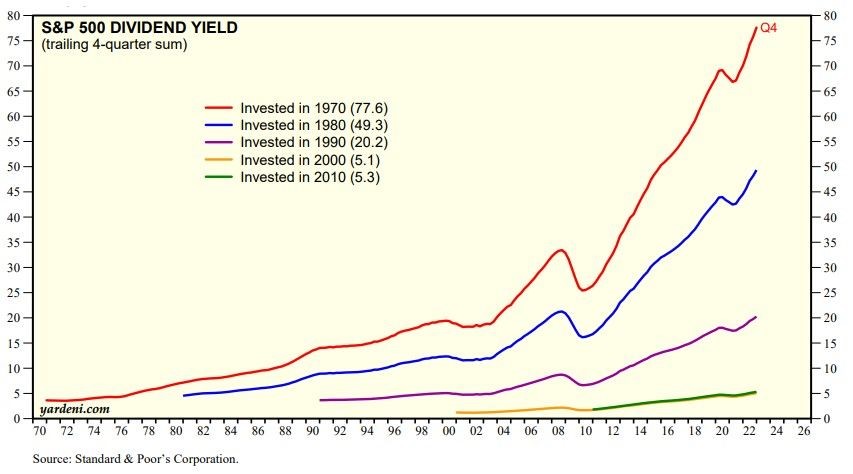

In fact, for many stocks in 2022, the only positive return they provided their owners was from a dividend. Further, the importance of dividends over time cannot be overstated for long term investors. In Chart 3 to follow, the current yield on an investor’s cost in the S&P 500 invested during various time periods dating from 1970 is outlined. Those current yields range from 77.6% (1970 vintage investment) to 5.1% (2000 vintage investment). In short, owning a well-diversified portfolio of growing companies which grow their dividends should do well for any investor over time.

CHART 3