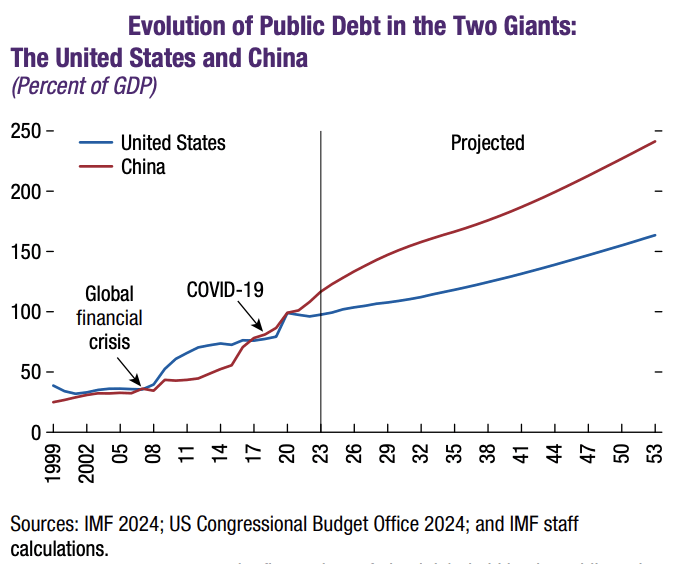

Or as it is popularly known, Buy Now Pay Later, is an increasingly used payment scheme which is a modern version of the old layaway plan. Saving for that thing one wants or needs is not and has not been for some time the way of our US government’s financing. Rather, whatever cash is needed to pay for whatever is wanted now is typically borrowed in advance with repayment due down the line – i.e., deficit financing. As a result, a significant level of debt has built up, as can be seen in CHART 1 following:

CHART 1

We hasten to add that America is not the only country in the world that uses deficit financing. As can be seen on Chart 1, China, the second largest economy in the world, has become even more profligate than the US. As of year-end 2023, the Chinese ratio of public debt to GDP approximated 125% with the US just under 100%. It is thought by numerous economists that once a country’s public debt surpasses 100% of GDP, debt burdens become too onerous and economies become unbalanced. So far through America’s history, deficit financing has worked. The US has never defaulted on its sovereign debt. But this is really starting to get expensive. In Chart 2 below, courtesy of the US Department of the Treasury, the reader will see the cumulative deficits by fiscal year rung up by our federal government from October 2019 through March 2024.

CHART 2

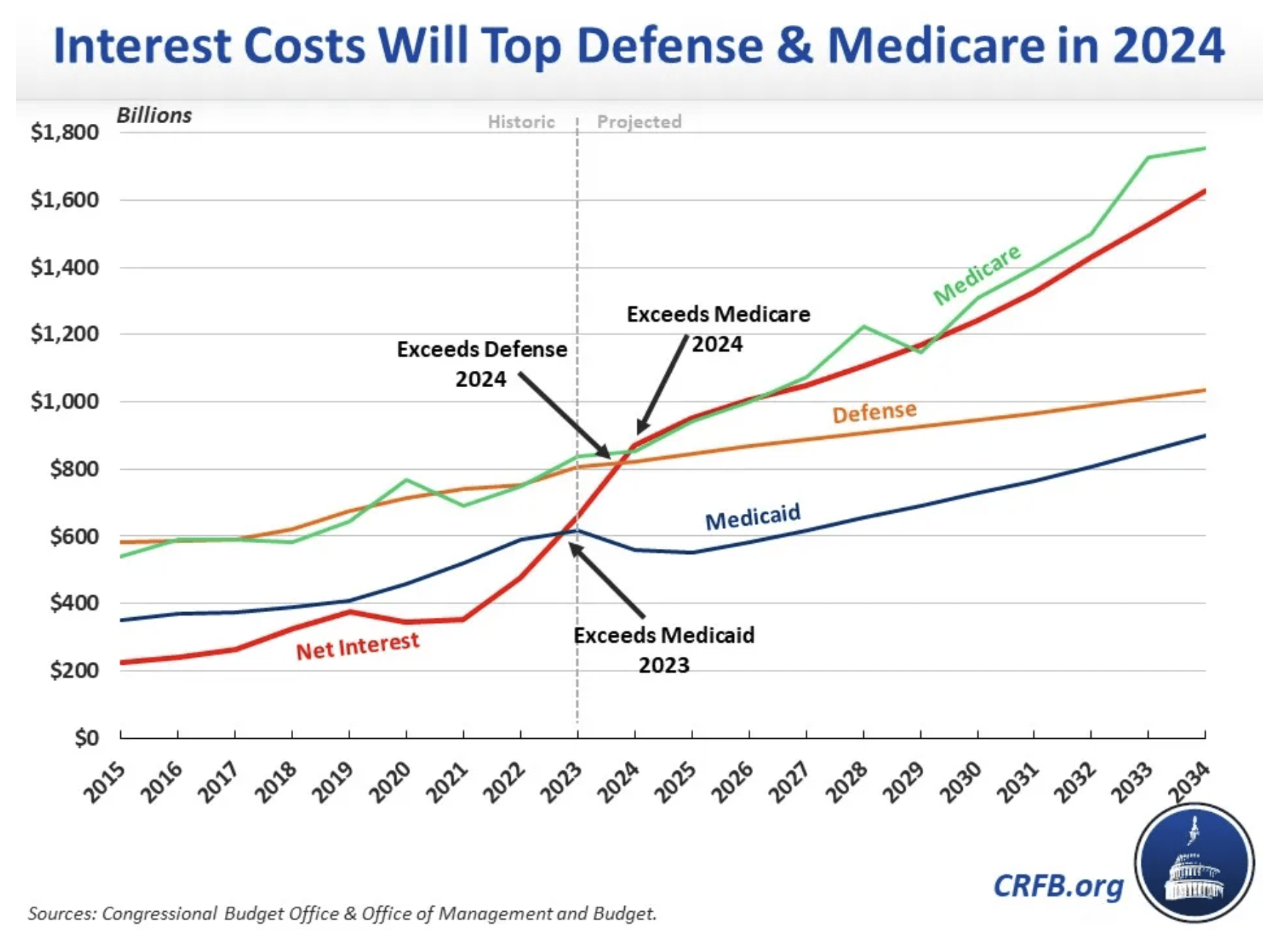

According to the Committee for a Responsible Federal Budget, in order to service America’s national debt, it will cost $429B – equal to 39% of the individual income taxes paid so far this year. That debt service cost is projected to rise to $870B by year’s end. This will mean that interest payments on the US federal debt will be larger than spending on both national defense and Medicare in 2024, as is depicted in Chart 3 below:

CHART 3

Between 2015 and 2023, America’s net interest costs tripled to $600B and are projected to exceed $800B in 2024. Those same costs which were considered manageable are now beginning to crowd and overwhelm heretofore considered sacrosanct programs like Medicaid, Medicare and defense. Such a trajectory is obviously unsustainable and if allowed to go on too much longer could have damaging effects on the US economy and currency. Last August we wrote about the US dollar and its “exorbitant privilege”(1) as the world’s only reserve currency, which gives the US many economic freedoms not available to any other country. We said then that the dollar is being challenged. But so far, no challenger has been up to the task of replacing our greenback. We should not be so presumptuous as to think that no challenger will ever succeed. There is an old saying we will paraphrase – it takes a lifetime to build a reputation, which can be lost in a moment. The US must get its deficit under control to lower its debt burden or it could become, as England experienced before, no longer the first among nations with all the attendant economic privileges.

________________________________________________________________________________

(1) A phrase coined by former French Finance Minister (and subsequently President of France) Valery Giscard d’Estaing

Baldwin Management LLC. (“Baldwin”) is a registered investment adviser that does not suggest a certain level of skill or training. The views and opinions expressed in this newsletter are those of Baldwin professionals and may change at any time without prior notification. There is no guarantee that the objectives of any investment program will be achieved. Any strategies or securities discussed is not a recommendation to invest in such strategies or to purchase or sell securities. Investing involves the risk of partial or total loss that investors should be prepared to bear. Past performance is not a guarantee of future results.. The value of investments may be worth more or less than their original cost when sold. Baldwin obtains information from third-party vendors believed to be reliable; however, the accuracy of such information is not guaranteed. For additional information regarding Baldwin’s business practices, registration status and important disclosures, please click on the following link and type our name in the space provided IAPD – Investment Adviser Public Disclosure – Homepage (sec.gov)