The year is half over and so far, stock markets around the world have done quite a bit better than most prognosticators earlier anticipated. The driving forces year-to-date have been better than expected corporate earnings and revenues and more positive than expected management outlooks for company performance through 2024 and for some, into 2025.

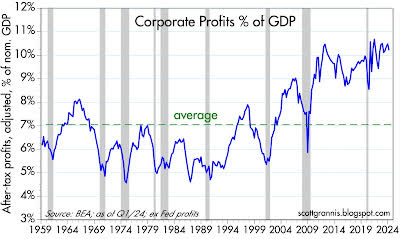

Chart 1

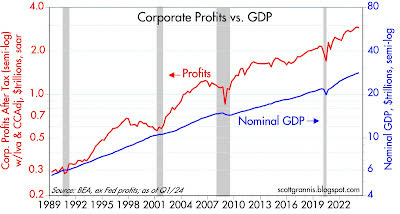

Chart 2

As can be seen in the above two charts, corporate profits relative to the size of the US economy are exceptionally strong. Investors are excited that management comments foresee further strength. Higher earnings usually support higher stock prices.

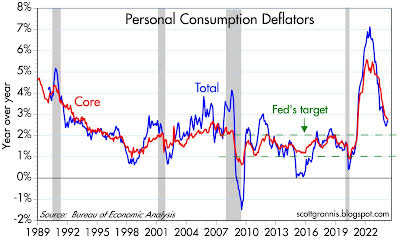

Restraining market ebullience has been a ratcheting back of market expectations about the number of interest rate cuts during 2024 – starting with seven in January, diminishing to an expectation of perhaps just one or two most recently. This is because there has been “noise” in various measures of inflation. Most data still point to a further reduction in inflation. The rate of decline has decreased – but the direction is still the same. Chart 3 demonstrates the considerable progress made in reducing inflation and how close the US is to the Fed’s target of a 2% inflation rate, when interest rates may be cut.

Chart 3

It should be noted that several other central banks around the world have already started to cut rates (the People’s Bank of China, the Bank of Canada and most importantly the European Central Bank), which is unusual as it is typically the American Federal Reserve Bank which usually leads. If one believes in some measure of central bank “group think”, which we do, then the US Fed should not be too far behind its compatriots.

DECARBONIZATION…….

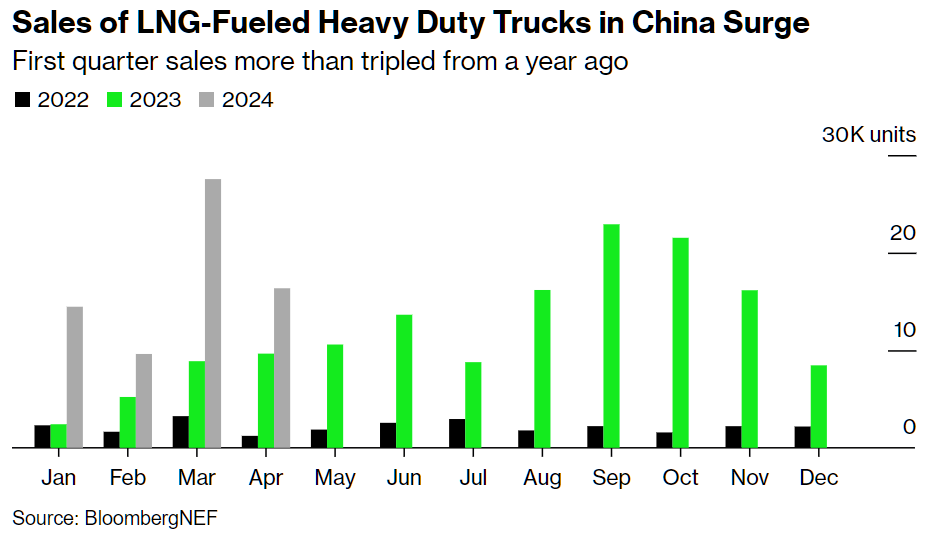

We have written on several occasions that we think the path forward to a “greener” world will not happen quickly and that the world will use multiple energy sources to power the future. It will not just be solar or wind, and the transition will not be by next week. An important part of the energy mosaic will be LNG (liquified natural gas). Already the world has witnessed its rapid adoption in Europe after the Russian invasion of Ukraine. After decades of dependence on cheap Russian-piped natural gas, Europe pivoted within months to establishing a new LNG infrastructure and essentially eliminated its dependence on Russian gas imports. In China, LNG is also an increasingly important part of its fuel mix. Today one in three heavy duty trucks sold in China use LNG – up from one in eight a year ago.

Chart 4

As of year-end 2023, about 7% of China’s heavy duty truck fleet were powered by LNG according to cvworld.com, a Chinese information provider.

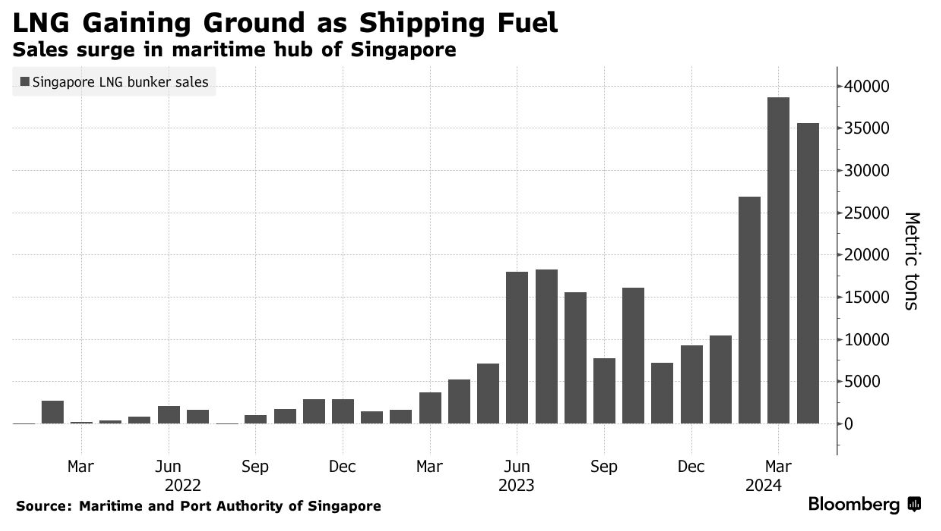

In shipping, the International Maritime Organization along with various governments are pressing vessel owners to decarbonize as shipping is one of the world’s greatest air polluters. Again, LNG is grabbing fuel market share, accounting for about 3% of the global marine fuels market, according to Wood Mackenzie, a world recognized energy consultant. In Chart 5 below the reader will note the dramatic increase in LNG metric tons sold.

Chart 5

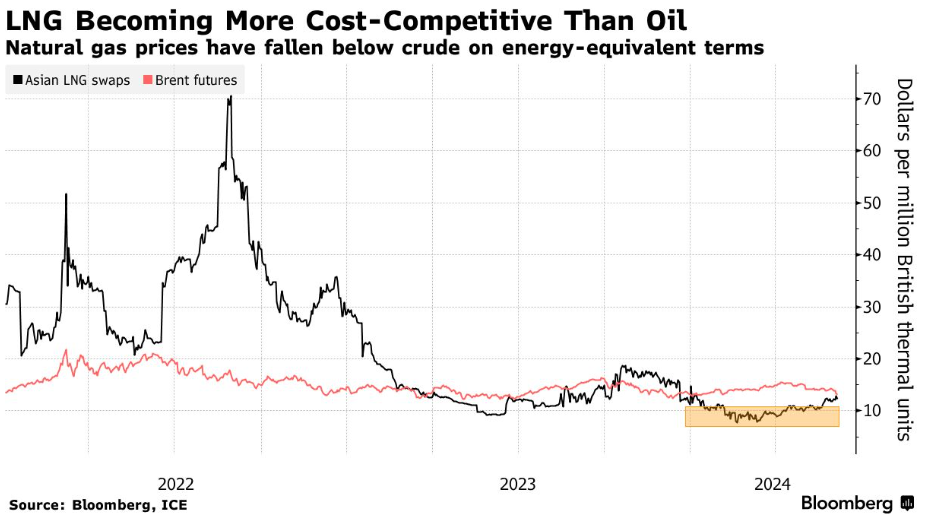

Why? An important reason, besides the fact that LNG is cleaner than today’s marine bunker fuel, is price. LNG is cheaper today than oil and looks to remain so with a surfeit of natural gas being produced around the world.

Chart 6

CHINESE ECONOMIC MISMANAGEMENT……….

China still has the second largest economy in the world. We remember when Japan held that position in the 1980’s and was slated to overcome the US economy before the year 2000. In the late 20th century, business schools were teaching Japanese management techniques because American management strategies had become passe. The US was losing its pre-eminent capitalist position to a more holistic, long-term thinking Japanese management philosophy. It did not happen. Instead, the tables were turned, and Japan suffered what has become known as a lost generation of economic progress – mired in disinflation. Japan has the world’s number three economy today. China is number two and again pundits are declaring that China will overtake the US. We are not convinced. While China has many of the capitalist characteristics that we have in America (because we taught them), China does not have them all. The Chinese economic infrastructure (i.e., its markets and banking system) is not as fluid or as well developed as that of the US. Moreover, Chinese regulators have not only market considerations when deciding issues before them – but also political masters to whom they answer. Finally, political power is increasingly flowing to President Xi – as is too much decision making. This centralized power lacks the responsiveness of a successful market system. It delays decisions, which slows the economy. Investors have taken note, and the reader will see investor reaction in Chart 7 below:

Chart 7

In Chart 7, on June 5, 2024, the combined market value of Nvidia, Apple and Microsoft was GREATER than the combined value of all the stocks actively traded on Chinese exchanges, excluding Hong Kong (but think Shanghai and Shenzhen), according to Bloomberg. That is quite shocking – but investors have spoken.

INTERESTING NEW ECONOMIC RESEARCH WITH PRACTICAL RAMIFICATIONS…….

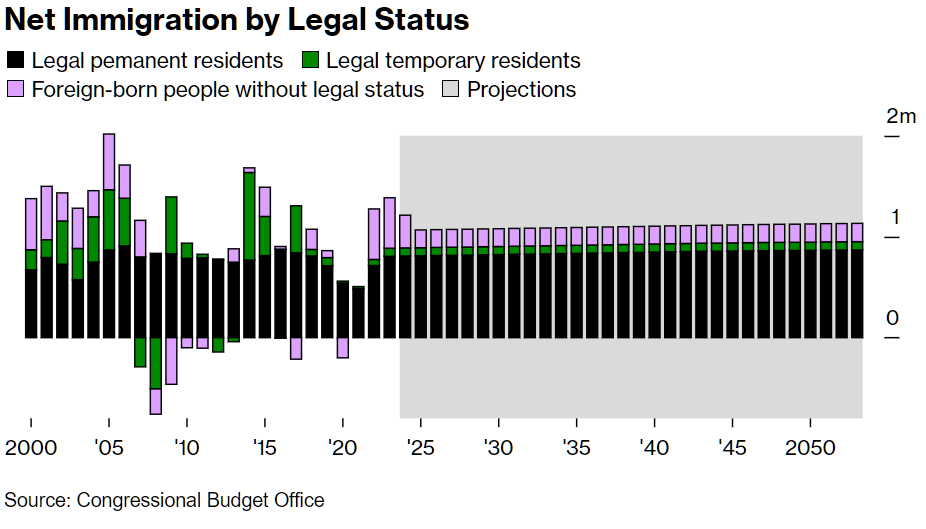

The Congressional Budget Office (CBO) is a 270-person agency of the US government filled with economists, lawyers and experts on taxation, health policy, energy and climate. They are regularly tasked with doing studies and recently finished work on why the US did not fall into a recession that so many were expecting. Their findings surprised quite a few on Wall Street. But after independent analysis, JP Morgan and BNP Paribas revised their economic forecasts to incorporate the CBO’s findings. Essentially, the CBO theorized convincingly that immigration and labor force participation contributed to economic output in 2023 and allowed the US to avoid an expected recession. More people working means more people producing and more people paying taxes.

Chart 8

Immigration is certainly a political hot potato these days with local burdens to consider. But a practical and beneficial result as outlined by the CBO has prompted Wall Street to reconsider certain of its economic algorithms for forecasting the future.

IN THE END…….

We still think that inflation is receding, and interest rates will be reduced. There might be “noise” in some inflation measures – but the direction is down. Lower interest rates will support higher stock and bond prices. Corporate earnings, revenues and cash flows as projected by company managements will be strong and we believe them. While most management teams are biased to the positive for their own corporate performance, they have also learned that Wall Street will punish stock prices of those companies that disappoint. Thus, most management pronouncements are conservative. The path of decarbonization is still being followed. But it is not straight and there is not just one. The decline of the US capitalist system has worried some, but it is not assured. There have been pretenders in the past as there are today. To rise to number one, a challenger must have an economic system as large, as deep, and as flexible as the American system. We do not see one on the horizon, yet.

A FINAL THOUGHT…

The opinions expressed in this Commentary are those of Baldwin Investment Management, LLC. These views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed. The reported numbers enclosed are derived from sources believed to be reliable. However, we cannot guarantee their accuracy. Past performance does not guarantee future results. We recommend that you compare our statement with the statement that you receive from your custodian. A list of our Proxy voting procedures is available upon request. A current copy of our ADV Part II & Privacy Policy is available upon request or at www.baldwinmgt.com/disclosures.